The stage is set for climate tech in the US

Temperature extremes, drought, wildfires, and destructive weather events have become more frequent and severe in North America as a consequence of climate change. The American West is having the most expansive drought in modern records leading to the first-ever water shortage for the Colorado River. Almost all of California is facing detrimental drought conditions, with 50 of the state’s 58 counties in a state of emergency amid excessive drought conditions according to the U.S. Drought Monitor Report. Meanwhile, as an effect the drought, the American West has also been hard hit by wildfires, which are now starting more frequently and much earlier than previously.

Yet, amidst the crisis, there are promising opportunities for a sustainable future led by innovation. In this ecosystem highlight, we zoom in on a selection of noteworthy start-ups that are developing groundbreaking technologies to combat and reverse climate change. We take a look at the 2021 VC activity in the category of climate tech and present a handful of venture capital funds devoted to investing in sustainable technologies.

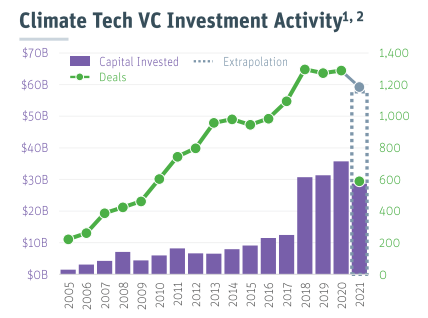

Venture capital investment in climate tech is soaring

According to a new report from Silicon Valley Bank, the US venture market has seen a rapid rise in capital available to companies working on solutions for climate-related issues.

Venture capital fundraising for US climate tech- focused funds in 2021 is on track to hit a record $21B and similarly, capital flowing from VC funds to US climate tech companies is on course to reach a record $49B.

Silicon Valley Bank, The Future of Climate Tech, July 2021

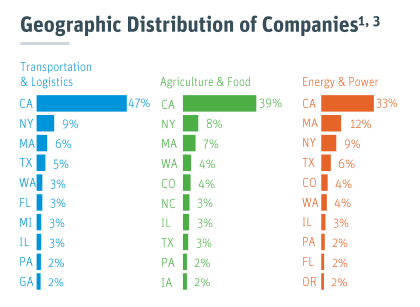

Climate tech is a broad category covering transportation and logistics, agriculture and food, energy and power, resources and environment, materials and chemicals, and other foundational sectors.

In the energy sector, energy storage solutions have captured most investments, according to Silicon Valley Bank. As the grid integrates more renewables and transportation becomes increasingly electrified, investments in long-duration energy storage and new battery chemistries are forecasted to rise. In agriculture and food, alternative protein companies are thriving, according to Silicon Valley Bank.

Like the overall VC landscape, climate tech venture investments are primarily being made in California, New York, and Massachusetts. The majority of companies currently being funded are at the early stage, with the modal series being Series A.

Silicon Valley Bank, The Future of Climate Tech, July 2021

Notable climate tech companies in 2021

There is an abundance of companies working on breakthrough technologies to solve issues related to climate change. Below, we offer you a snapshot of some of the most promising startups that have raised capital in 2021:

Apeel

Apeel has developed a plant-based fruit coating material and technology intended to protect fresh produce. Food waste is a massive problem, and America wastes roughly 40 percent of its food. The company’s plant-based protection allows for longer-lasting produce by using materials already found in the skins, peels, and seeds of all fruits and vegetables, enabling clients to minimize food waste from the farm to the kitchen.

The company raised $280 million through the combination of debt and Series E venture funding on August 18, putting the company’s pre-money valuation at $2.2 billion. The funds will be used to expand retail and supply partnerships, advance the company’s data and insights initiatives to further stamp out food waste, accelerate innovation and sustainability in fresh food supply chains, and speed up the availability of longer-lasting produce in the U.S., U.K., and Europe.

Form Energy

Form Energy was founded by former Tesla employees with the ambition to solve the challenge facing the electric grid: How to manage the multi-day variability of renewable energy without sacrificing reliability or cost.

The company is developing a multi-day energy storage technology that will enable the grid to run on low-cost renewables year-round. The company’s first commercial product is a rechargeable iron-air battery capable of storing electricity for 100 hours at system costs competitive with legacy power plants.

Form Energy raised $240 million of Series D venture funding in a deal led by ArcelorMittal alongside 14 other investors on August 24, 2021, putting the company’s pre-money valuation at $960 million. The funds will be used to accelerate its market entry. Breakthrough Energy Ventures and Temasek also participated in the round.

Pivot Bio

Sustainable agriculture depends on a sustainable fertilizer source. Today, growers rely on synthetic fertilizer to supplement soil nitrogen and boost yields, but this input negatively impacts our environment. Synthetic nitrogen is a leading cause of greenhouse gas emissions from farming and its runoff significantly contributes to the more than 500 global oceanic dead zones, according to the UN.

Pivot Bio is a developer of microbial nitrogen fertilizers intended to replace synthetic nitrogen fertilizer. The company’s fertilizer helps farmers to grow crops that can capture and metabolize nitrogen from the atmosphere, reducing the need for petrochemical fertilizers, enabling farmers to reduce the cost of farming, improve health and create a future with cleaner water and air. The company’s product has replaced synthetic nitrogen on more than 1 million crop acres in 2021 alone.

Pivot Bio raised $430 million of Series D venture funding in a deal led by DCVC and Temasek Holding on July 19, putting the company’s pre-money valuation at $1.27 billion. Tekfen Ventures, Bunge Ventures, CGC Ventures, Prelude Ventures, Breakthrough Energy Ventures, G2VP, Generation Investment Management, and Rockefeller Capital Management also participated in the round.

Photo: Pivot Bio via www.pivotbio.com

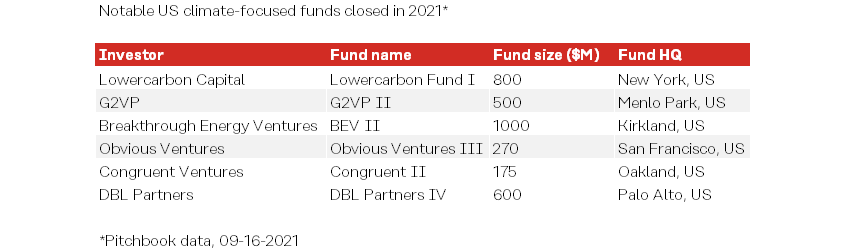

VC funds committed to climate tech

As VC fundraising in climate tech continues to increase, funds dedicated to the sustainability agenda are thriving. Below, we provide you with an overview of some of the most notable funds in the US:

Breakthrough Energy Ventures was established by Bill Gates and a coalition of investors with the mission of supporting the innovations that will lead the world to net-zero emissions. They invest in technologies with the potential to reduce at least half a gigaton of GHG emissions. Jeff Bezos, Ray Dalio, Michael Bloomberg Reid Hoffman, and Jack Ma are among the investors in the fund.

G2VP is spun out of Kleiner Perkin’s Green Growth Fund. It is a venture and growth investing firm focused on emerging technologies driving sustainable transformation across traditional industries. The team invested early in Proterra; a company designing and manufacturing zero-emission heavy-duty vehicles. The company went public in a $1.6 SPAC deal in 2021.

Congruent Ventures is investing and creating the companies that will positively impact how we move, create, eat, and live. In their portfolio is, among others, Meati Foods; a company specializing in the production of fungi-based steaks that are minimally processed and made from natural ingredients using a fermentation process.

DBL Partners was formed with a “double bottom line” investment strategy to invest in companies that can deliver top-tier venture capital returns while working with the portfolio companies to enable social, environmental, and economic improvement in the regions in which they operate. The firm is known for being an early investor in Tesla and Planet.

Lowercarbon Capital is the new kid on the block. Their investment strategy read: “Lowercarbon Capital backs kickass companies that make real money slashing CO2 emissions, sucking carbon out of the sky, and buying us time to unf**k the planet”. Chris Sacca is the co-founder of LowerCarbon Capital – primarily known for his early investments in Twitter, Uber, Instagram, Twilio, and Stripe.

Want to know more?

If you are interested in diving deeper into the latest trends in climate tech, we recommend the following pieces:

- The future of climate tech: Report by Silicon Valley Bank

- A new era for climate-focused venture capital: Greentech Media podcast with Emily Kirsch, founder and CEO of Powerhouse